ClientEarth uses Data Desk research to challenge new plastics plant

While our latest technical work reveals methane emissions in its upstream supply chain

Yesterday, ClientEarth filed a court challenge in Belgium over INEOS’s Project ONE, a plan to build a new ethylene cracker in the Port of Antwerp. The filing is the latest action in a long-running legal battle, which saw the petrochemical company’s permit for the facility cancelled in 2023 and subsequently re-issued the following year.

Like other crackers (a type of refinery) in INEOS’s portfolio, Project ONE will be fed with ethane shipped from the United States, a by-product of shale gas extraction in places like the Appalachian and Gulf Coast basins. The chemical it produces, ethylene, will largely be used for making plastics.

At issue in the case is whether the project’s Environmental and Social Impact Assessment (ESIA) should take into account sources of greenhouse gas emissions beyond the operation of the plant itself, known under the Greenhouse Gas Protocol as Scope 3 emissions. But with the ESIA itself providing minimal information, litigators struggled to assess the full scale and scope of these impacts.

To address this, ClientEarth commissioned Data Desk to produce a full analysis of the Scope 3 emissions likely attributable to the project once operational. Using a conservative methodology relying on published emissions factors from the latest academic work, we found that the 655,000 tonnes of annual CO2-equivalent emissions (tCO2e) attributable to the plant itself are likely to be accompanied by between two and three million tCO2e of additional emissions from its upstream and downstream supply chains.

Data Desk’s report was filed as evidence in the case on Thursday and is available from ClientEarth on request.

While we assessed Project ONE’s full supply chain, including emissions from liquefaction of ethane in the US, shipping, polymerisation and the ultimate disposal of plastic products, the most contentious point is around upstream methane emissions from the initial shale gas extraction, commonly known as fracking. These occur due to planned venting or accidental leaks at ‘wet gas’ wells producing the natural gas liquids (NGLs) from which ethane is extracted.

Our conservative — though still troubling — estimate of Project ONE’s upstream emissions is based on published factors from a 2025 life cycle analysis of US ethylene production. But, as we note in the report, there is strong reason to suspect that these figures are significant underestimates.

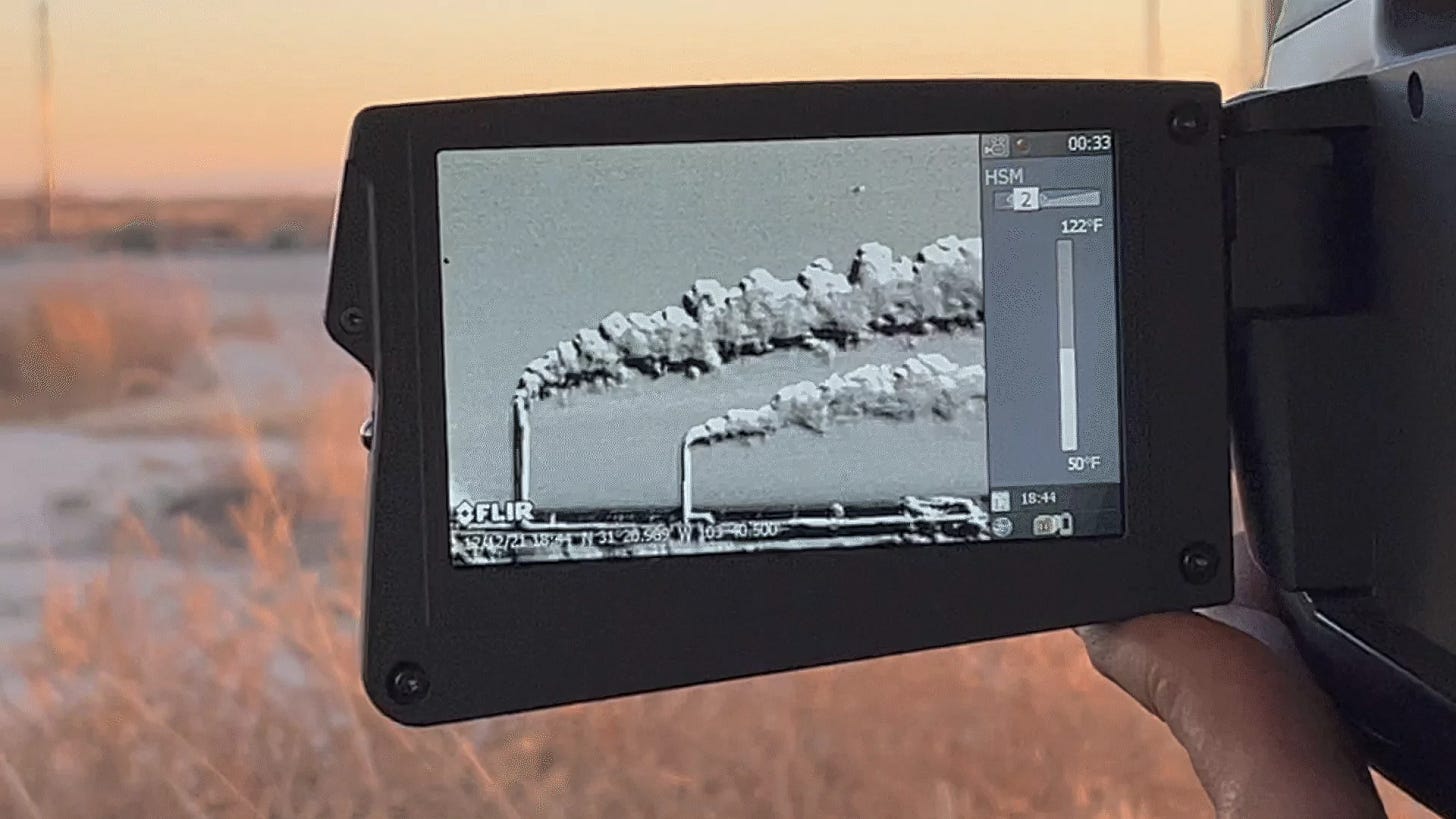

Recent studies based on satellite observations of oil and gas basins have cast doubt on the bottom-up figures traditionally used in emissions reporting and modelling in the US. In particular, these studies suggest that large but infrequent ‘super-emitter events’ — defined by the US Environmental Protection Agency (EPA) as any incident in which more than 100 kg of methane is emitted per hour — make up a much larger proportion of overall emissions than previously thought.

Nom de plume

In conjunction with our work for NGOs, media organisations and litigators, Data Desk develops lightweight technical tools to automate time-consuming aspects of the research process. One such project is Nom de plume, an internal tool that we’re using to navigate the profusion of new methane detections data being published by organisations like Carbon Mapper.

Our tool is simple but effective: it grabs details of the most recent super-emitter plumes recorded by Carbon Mapper, then for each one uses a series of geospatial databases of oil and gas infrastructure — including the Environmental Defense Fund (EDF)’s wonderful OGIM and our own scraped versions of Texas and Louisiana state regulatory data — to find the most likely culprit.

Crucially, given the extreme density of oil and gas operations in some parts of the US, Nom de plume narrows the results down to cases where all or nearly all nearby infrastructure is owned by the same operator, giving us high confidence in the attribution at the company level. As a next step, we plan to incorporate data on gatherers and purchasers, so that we can assess emissions in the supply chains of downstream companies too.

To put the tool to the test, we ran it on a subset of plumes detected in June and July 2025, each of which had been assessed by Carbon Mapper as emitting at more than 10 times the rate required to qualify as an EPA super-emitter. We then searched the results both for INEOS itself as an operator and for its current upstream ethane suppliers, as declared in Project ONE’s ESIA.

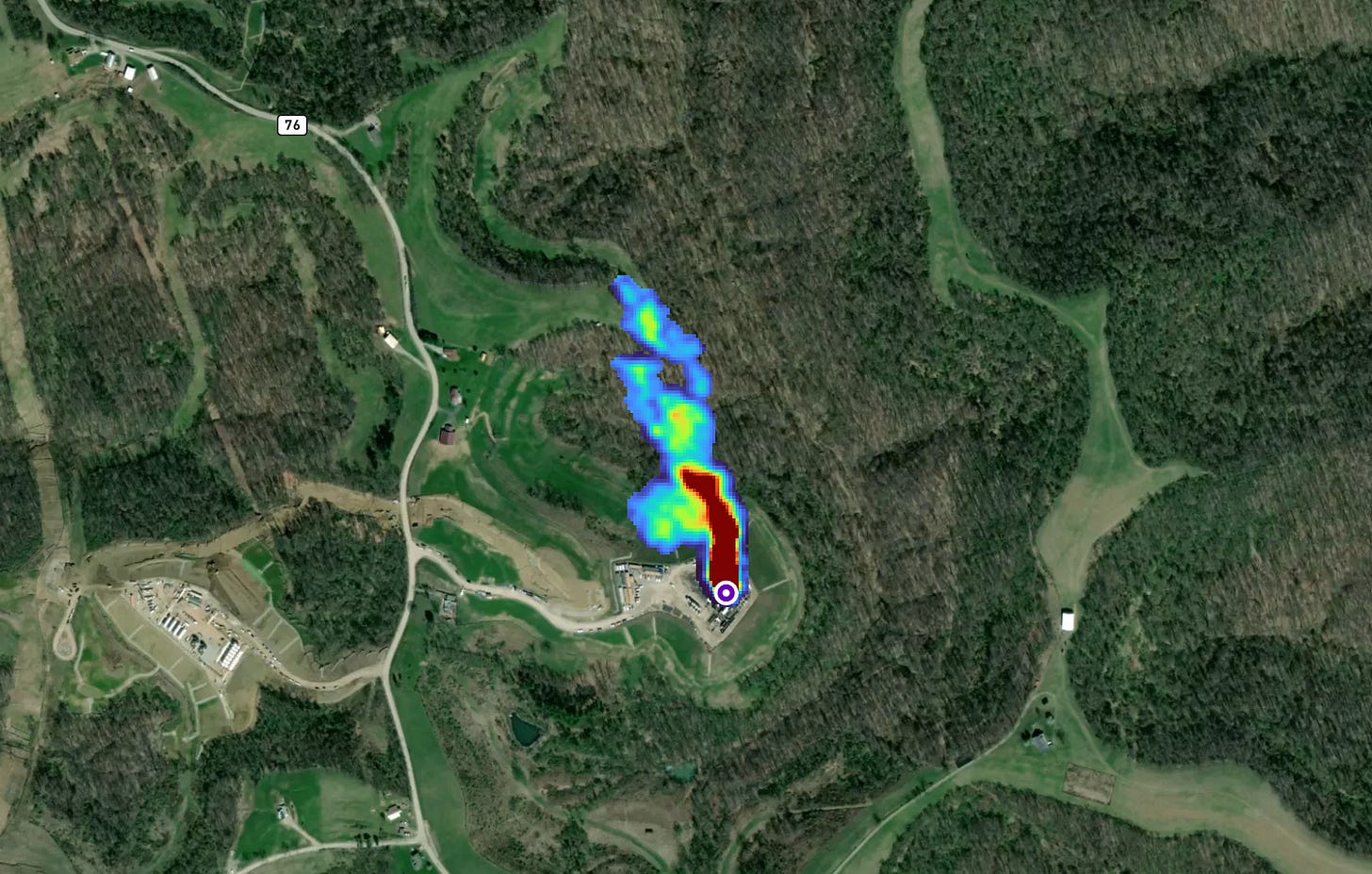

In just a two-month period, our tool identified three high-confidence attributions of plumes linked to INEOS and its suppliers, with many more falling below our conservative 10x threshold. These comprised one plume apparently originating from storage tanks on an INEOS-operated well pad in Texas’s Eagle Ford shale (more than one tonne per hour, per Carbon Mapper) and two plumes, each emitting around two tonnes per hour of methane, from wells in the Appalachian basin operated by EQT, an INEOS supplier.

Asked for comment on the plume from the INEOS-operated location, a spokesperson noted that it was one of 700 sites operated by the company in the region and that the emissions event in question related to “a planned, recorded, and reported maintenance activity being performed at the wellsite.” They further noted that “the emissions associated with these types of maintenance events are reported annually to the EPA.”

Physical limits?

The company’s response speaks to a persistent misconception in work on methane emissions from the global oil and gas industry. While commonly referred to as ‘leaks’, studies have shown that the bulk of these emissions comes from improper flaring and deliberate venting for operational reasons.

NGOs like Oilfield Witness (which has also worked on emissions from INEOS’s upstream ethane production and submitted a report in the ClientEarth case) have made this point eloquently: achieving the rock-bottom emissions rates being targeted by some companies and certification schemes is likely to be physically impossible without a level of infrastructure investment that would make the extraction itself unprofitable. Like other companies invested in exporting US energy to Europe, where stringent new methane regulations threaten to penalise the dirtiest operators, INEOS has positioned itself squarely in this low-emissions camp, seeking to make the case that its suppliers operate some of the cleanest production in the US.

The wells in this case were purchased by INEOS from Chesapeake Energy in October 2022. Just over a year earlier, Chesapeake had announced that it was pursuing an ambitious emissions monitoring programme for the assets under the MiQ scheme, aiming to achieve certification for low emissions by the end of 2021; however, no results from this process appear to have been published.

Commenting on the divestment at the time, Chesapeake’s CEO framed its Eagle Ford assets — now owned by INEOS — as “non-core to our future capital allocation strategy”, contrasting them with production in the Marcellus and Haynesville shale which carries “advantaged emissions profiles.” In other words, Chesapeake — conscious of the impending EU regulations and its existing and future commitments to supply LNG feedgas — may have sold these assets precisely to improve its own emissions figures.

Responding to our findings, INEOS’s spokesperson was clear that “we aim to continually improve the performance of the assets we operate.” This is a laudable aim, but whether it’s achievable within the twin constraints of physics and commercial logic remains to be seen. With satellite methane monitoring still in its infancy, we’ll certainly keep watching.